Swaps

- Home

- Instruments

- Swaps

A Swap is a paper hedge agreement

A Swap is a paper hedge agreement that allows you to fix your energy prices at a predefined level, independent of future market movements.

Here’s an example of how it works. To begin, you and Global agree upon:

- THE MONTHLY VOLUME

- AN APPROPRIATE FUEL PRICE INDEX (PLATTS/ARGUS)

- A HEDGING PERIOD (E.G. 2 MONTHS)

- A FIXED PRICE (E.G. 100 PER TONNE)

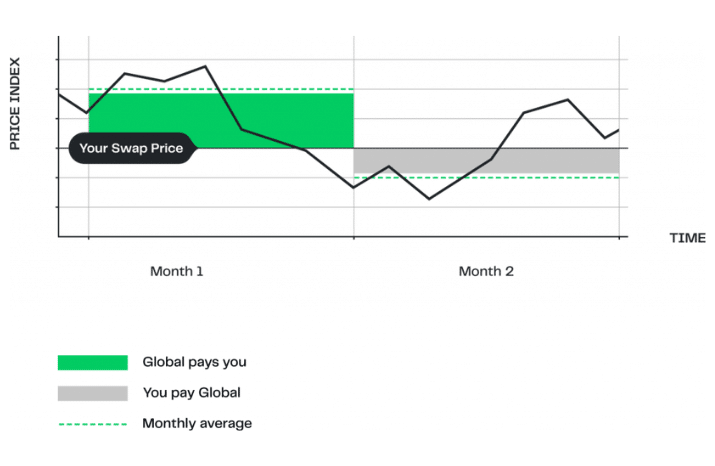

Month 1

Monthly average settles, e.g. at 120 per metric tonne (20 above the Fixed Price).

Global pays you 20 per tonne in cash, compensating you against the increase in spot prices.

Month 2

The monthly average price was 90 per metric tonne (10 below the Fixed Price).

You pay Global 10 per tonne in cash, which counterbalances the lower spot prices.

Result

A fixed, predictable energy cost, as the changes in the spot prices, are offset by the payments of the Swap agreement.

At the end of each calendar month, the settlement amount is based on the difference between the monthly average of the price index and the Fixed Price.

Three good reasons to use this strategy:

- Rising energy prices could seriously undermine your business

- You have a set budget and would like to lock in your future energy prices

- You would like effective security against fluctuating energy prices

BENEFITS

Protection from price volatility, flexibility in physical supply & no upfront premium

DISADVANTAGES

Opportunity loss if market prices fall & potential basis risk