What we do

- Home

- Our company

- What we do

4 Reasons to Hedge

1.

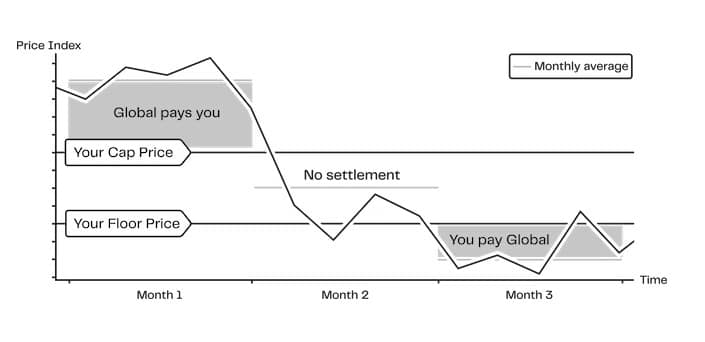

Hedging against energy price risk means strategically using financial instruments or market strategies to offset the risk of any adverse price movements.

Thus hedging, for the most part, is a technique that is meant to reduce potential loss (and not maximize potential gains).

2.

Good risk management plans allow businesses to take advantage of this stability to lower their finance costs or their prices in markets that are considered crucial and vital to their company’ continued growth.

3.

Companies attempt to hedge price changes because those fluctuations are risks peripheral to the central business in which they operate

4.

Moreover, hedging can be utilized to preserve or increase competitiveness. Businesses compete not just with other domestic businesses in their industry but also with businesses worldwide.

At Semantic Solution Group we plan to be the global energy risk manager of choice, providing access to all energy markets.

“A greener future requires greater risk management”